The True Cost of Manual Inventory Management: What Spreadsheets and Daily Reconciliation Really Cost Your Business

TL;DR: Manually updating inventory across multiple channels feels free because there's no software line item. But when you calculate staff time on daily reconciliation, monthly close procedures, exception handling, and error correction, most businesses discover they're spending $78k-180k annually on labour. Add another $40k-80k in hidden costs from overselling, emergency freight, and delayed growth. This guide provides a framework for calculating the actual costs of manual processes and helps you build the case for automation.

The Invisible $100k+ Problem Nobody Budgets For

Your CFO asks what inventory management software costs. "$36,000 annually," you say. They wince. "That's expensive for something we're doing manually."

Here's what they don't see: Your operations manager reconciling three spreadsheets before 9am. Your finance team adding days to month-end close. Customer service apologising for overselling the same product again. The wholesale channel you've been "planning to launch" for nine months because operations can't handle another channel.

Manually updating inventory feels free. There's no line item. No budget allocation. No purchase order.

But someone is paying for it. Your operations team spends hours daily reconciling what the systems should be tracking. Your finance team extends close because the numbers don't match. Your growth is constrained because your infrastructure can't scale.

When you actually track the time and calculate the true cost, most mid-sized retailers discover they're spending $78,000-180,000 annually on manual inventory management: labour burden, error correction, emergency freight, and the revenue opportunities you're delaying.

Your CFO is optimising a $36k software decision while missing a six-figure operational reality.

The Time Audit Framework: Where Hours Actually Go When Manually Managing Inventory

Manual inventory management hides in plain sight. Nobody has "inventory reconciliation" as their only job title. It's distributed across operations, finance, customer service, and warehouse teams as "part of the role." Which means nobody actually knows what it costs.

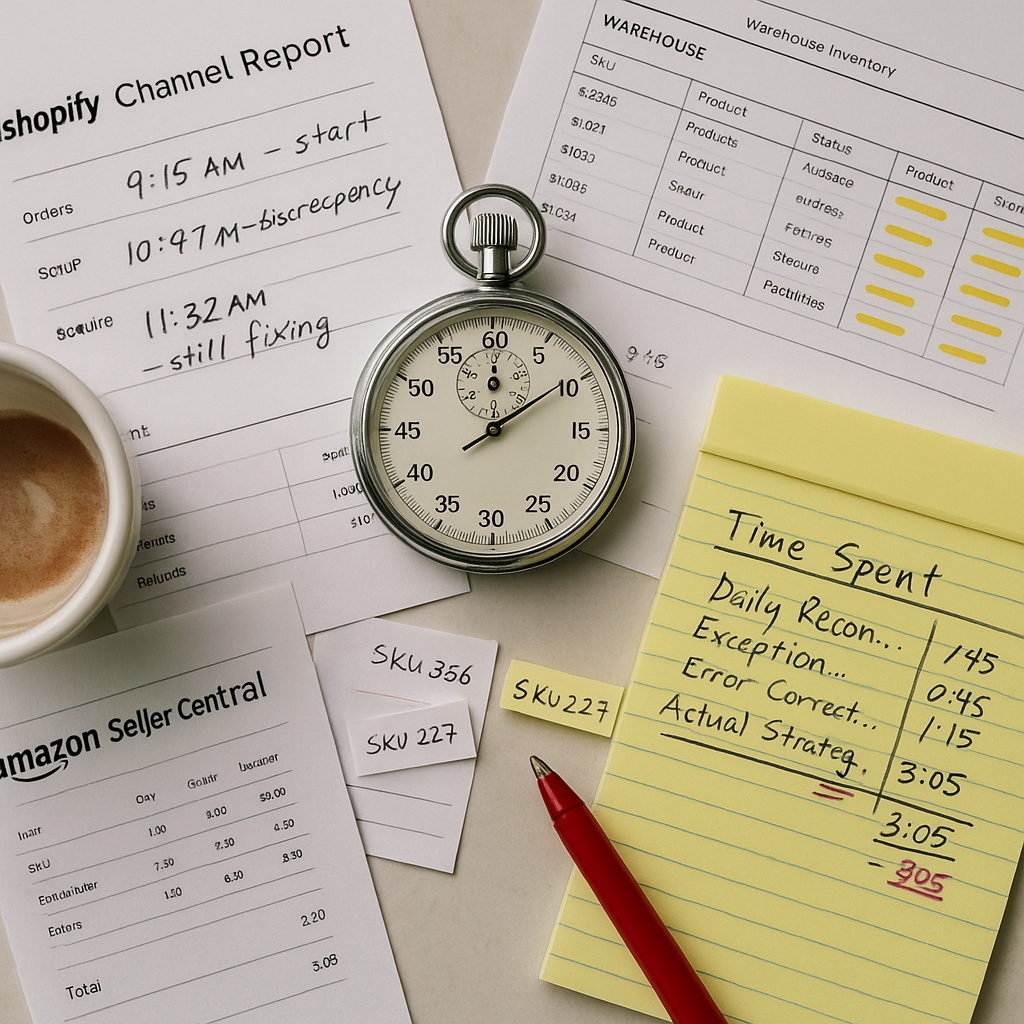

Here's how to find out: Track time across four categories for two weeks. Don't estimate. Actually track with timers.

| Activity | What It Involves | Typical Time Investment | Annual Cost* |

|---|---|---|---|

| Daily Reconciliation | Export orders from each channel, compare against warehouse inventory, investigate discrepancies, update failed syncs | 60–120 min/day | $18–28k |

| Monthly Close | Pull reports from each channel, cross-reference with physical counts, resolve discrepancies, adjust accounting system | 8–15 hours/month | $8–14k |

| Exception Handling | Managing cases where reality doesn't match the spreadsheet, routing edge cases, making judgment calls | 1–3 hours/day | $15–35k |

| Error Correction | Fixing overselling incidents, SKU mapping errors, discount failures, inventory adjustments | 4–8 hours/week | $12–24k |

Total annual burden: $53-101k in direct labor (mid-sized operations)

*Based on $45-60/hour loaded cost depending on role

One fashion retailer tracked this for two weeks and discovered their operations manager spent 7.5 hours weekly on reconciliation. "I thought it was maybe 30 minutes," she said. When they added up time across all roles, the total hit $68,000 annually for something they thought was "basically free."

Your Direct Labor Cost by Business Size

The labour burden scales predictably with order volume:

| Business Size | Orders/Day | Channels | Annual Labor Cost |

|---|---|---|---|

| Small | Under 100 | 2–3 | $32–42k |

| Mid-sized | 100–300 | 3–4 | $58–78k |

| Large | 300+ | 4+ | $98–135k |

The pattern is consistent: businesses underestimate manual inventory burden by 3-5x. The gap between perception and reality is where the business case for automation lives.

The Hidden Costs Most Businesses Miss

Direct labour is visible once you track it. But manual inventory management creates hidden costs that rarely show up in anyone's budget.

Opportunity Cost: What You're Not Building

Your operations manager spending too much time managing inventory isn't optimising warehouse layout, analysing purchasing patterns, or building supplier relationships. That's strategic work that could drive actual business value.

What's a 1% margin improvement worth? For a $5M business, that's $50,000 in additional profit. That's the kind of work your team could be doing instead of reconciling spreadsheets.

Growth Constraints: What You're Delaying

Manual inventory blocks channel expansion. In our experience implementing end-to-end systems for retailers, launching a new channel takes 4-6 months with manual inventory systems versus 2-3 weeks with proper platforms. If that wholesale B2B channel could generate $40,000 monthly, every delayed quarter costs you.

Peak season tells the same story. Manual reconciliation burden scales linearly with order volume. The businesses that hit capacity limits during Black Friday weekend aren't warehouse-constrained, they're operations-constrained. You're leaving revenue on the table because your team can't process it fast enough.

Error Costs: The Budget Nobody Tracks

Manual processes create errors. Errors cost money.

According to IHL Group's 2023 retail inventory research, inventory distortion (stockouts and overstocks combined) costs retailers $1.77 trillion globally. While that's the macro picture, the micro reality for individual businesses is just as painful.

Overselling incidents cost $150-300 each when you factor in credits, emergency freight, and customer service time. At 8-15 incidents monthly for businesses running three or more channels manually, that's $18-42k annually. Plus, 15% of affected customers don't return.

Phantom stockouts from data lag mean lost sales. One solar equipment distributor discovered they'd been writing off $24,000 annually in "inventory discrepancies" that disappeared entirely after implementing proper inventory management. The discrepancies weren't theft or damage. They were data errors from manual tracking.

Real Scenarios by Industry Vertical

A fashion retailer with 2,500 SKUs across Shopify, Amazon, and Nordstrom Marketplace discovered they were spending too much time managing inventory manually. Daily reconciliation took 2 hours. Variant mapping errors occurred multiple times weekly. Monthly close required 14 hours because size/color combinations multiplied the work.

When they tracked everything (labour, size availability errors causing lost sales, overselling during seasonal releases, and a six-month TikTok Shop launch delay), the total annual cost hit $336,000.

After implementing a proper Inventory system, they cut labor burden by 78% and launched TikTok Shop in three weeks. Six-month payback.

The pattern repeats across industries. Building supplies distributors face freight calculation complexity and B2B approval bottlenecks. Electronics retailers struggle with serial number tracking for warranty claims. The specific pain varies, but the financial burden remains consistent: businesses doing 150-300 orders daily across multiple channels typically discover $150-300k in annual costs they didn't know they were carrying.

The ROI Reality

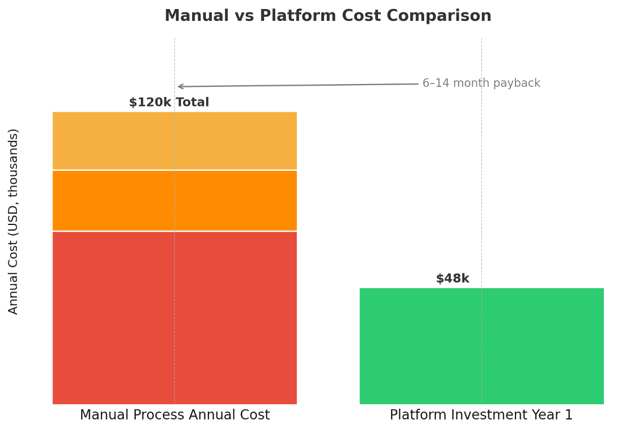

Typical inventory management platform investment: $34-80k in Year 1 (implementation plus annual platform fees).

What you get back:

- Labor savings from eliminating 70-80% of manual reconciliation

- Error reduction from fewer overselling incidents and stockouts

- Growth enablement when new channels launch in weeks instead of months

Most mid-market retailers see 6-14 month payback. Platform fees continue at $24-48k annually after Year 1, while labor savings and growth benefits compound.

That outdoor equipment retailer who discovered they spent $71,000 annually on manual inventory? They saw 8-month payback implementing Exsited Inventory at $48,000 annual platform cost.

The question isn't whether automation pays for itself. It's whether you can afford to keep burning cash on manual processes while constraining growth.

Making the Business Case to Your CFO

Your CFO thinks in terms of line items and budget allocation. Manual inventory doesn't appear on the P&L as a cost center. It's invisible, which makes it hard to eliminate.

Build your business case with actual tracked hours, not estimates. Two weeks of time tracking across all roles touching inventory provides credibility. Present total cost (labor plus errors plus growth constraints) against platform investment with conservative ROI assumptions.

One key comparison: A full-time inventory coordinator costs more than software but can't eliminate the work. Software eliminates 75% of it, scales infinitely, and costs less.

For vendor due diligence, ask for customer references from businesses using the platform 2+ years. For detailed vendor evaluation frameworks including RFP questions and demo criteria, see our guide to evaluating NetSuite Shopify integration software.

When Manual Makes Sense (The Honest Assessment)

Stay manual when you're under 50 orders daily on 1-2 channels with under 200 SKUs, no growth plans for 12+ months, and your time audit shows under $15,000 annual cost.

Automate when you hit 100+ daily orders, operate 3+ channels, experienced recent overselling, plan channel expansion, or your team is spending too much time managing inventory and no longer trusts the numbers.

At that scale, manual inventory isn't saving money. It's consuming invisible costs while constraining visible growth.

What Happens Next

If your time audit revealed costs under $30,000 annually, optimise your current processes. You're not at the inflection point yet.

Between $30-80k annually? Start evaluating platforms. For complete multi-channel inventory strategy.

Over $80k annually? You're past the inflection point. Every quarter you delay costs $20-40k in labor plus growth constraints.

Want to calculate your specific costs with someone who's analysed hundreds of these scenarios? Book a workflow review. We'll walk through your time audit, identify hidden costs, and outline what proper infrastructure would cost and save.

Most businesses discover they're already paying for inventory management software. They're just paying in labour cost instead of platform fees, getting worse results, and constraining growth in ways they never calculated.

References

IHL Group (2023). Retail Inventory Distortion: The Good, the Bad, the Ugly.

https://blueyonder.com/resources/retail-inventory-distortion-report