Multi-Warehouse Inventory Problems: Complete Guide for Businesses That Have Outgrown Their Inventory System

TL;DR: Multi-warehouse inventory problems emerge when you've outgrown your inventory system's single-location assumptions. This guide explains when shipping costs or delivery times signal expansion necessity, details fulfilment routing strategies, and shows why multi-warehouse orchestration belongs in an operations platform. If you're experiencing allocation failures, split-brain syndrome, or exponential reconciliation complexity, this is your roadmap from chaos to control.

The Invisible Tax on Single-Warehouse Success

Multi-warehouse inventory problems don't announce themselves with sirens. They accumulate gradually until one peak season exposes that you've outgrown your inventory system entirely.

Your Brisbane warehouse ships to Perth in five days at $18 per parcel. Melbourne gets two-day delivery at $9. Sydney arrives next-day for $7. Same product, three completely different customer experiences and unit economics.

This geographic penalty constrains growth predictably. During peak sales, Sydney customers get 24-hour delivery and post glowing reviews while Perth customers wait nearly a week. Geography becomes the growth ceiling.

Multi-warehouse operations solve physics problems that software cannot. They also introduce inventory's most frustrating paradox: you'll have too much stock overall and not enough where you need it, simultaneously.

According to IHL Group's 2023 research, inventory distortion costs retailers $1.77 trillion globally, with personnel and process issues contributing $520 billion; systemic problems that multi-warehouse orchestration addresses through location-aware allocation.

When Single-Warehouse Assumptions Break

Single-warehouse operations carry hidden assumptions that break predictably at scale.

Signs You've Outgrown Your Inventory System

You've outgrown your inventory system when single-warehouse logic can't handle your operational reality. The symptoms appear gradually: shipping costs eating into margins, customers in distant regions waiting days longer for delivery, marketing hesitant to run regional promotions because fulfilment can't keep up. These aren't inventory problems, they're architectural constraints revealing themselves through operational pain.

The Cost-Reduction Threshold

When distant-zone shipping exceeds 25-30% of total shipping costs, a regional warehouse typically pays for itself within 18 months.

Example: 1,000 monthly orders to WA/SA at $18 shipping = $18,000 monthly cost. Regional warehouse lease + staffing: $8,000 monthly. Reduced shipping (averaging $7): $7,000 monthly. Net savings: $3,000 monthly ($36k annually).

Regional Demand and Delivery Speed

When 20% or more of your orders consistently ship to one geographic region, you've reached critical mass for regional inventory.

According to Deloitte's B2B Commerce research, front-runner companies leveraging omnichannel strategies see customers spend 62% more on average when buying experiences are consistently positive. Delivery speed increasingly defines that positive experience.

The 3PL Decision Point

Third-party logistics (3PL) partnerships lower the entry barrier for multi-warehouse operations. Consider 3PLs when testing regional markets, handling seasonal volume fluctuations, or when capital preservation matters more than margin optimisation.

3PLs make sense until volume justifies owned warehouses. That inflection point typically arrives around 500-800 orders monthly per location.

The Platform Approach to 3PL Integration

Whether you choose 3PL, owned warehouses, or hybrid models, operations platforms provide strategic value by connecting sales channels, ERP, and warehouses through one integration layer that adapts as your warehouse strategy evolves.

We've seen businesses delay expansion by 6-12 months because "changing our warehouse strategy means rebuilding all our integrations." That constraint disappears when orchestration lives in a platform layer.

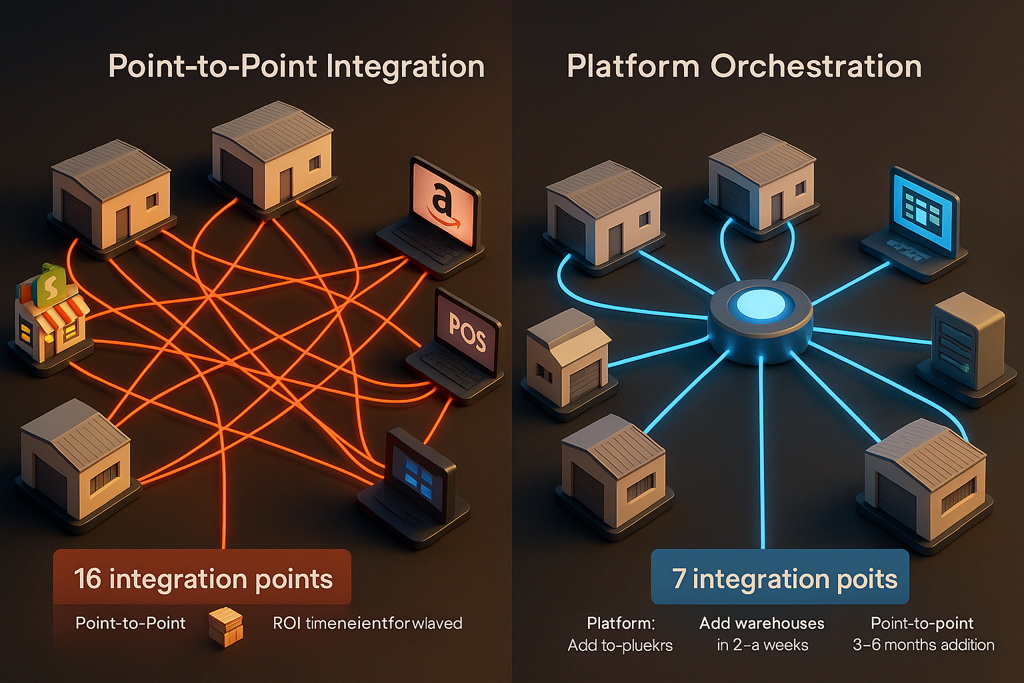

A 2023 systematic review of ERP system implementations found that "integration

approaches" ranked as the second most significant concern among researchers analysing enterprise software deployments, with successful implementations depending on simplified integration architecture rather than complex point-to-point connections. We see this validated daily: businesses using platform-based orchestration add new warehouses in 2-4 weeks,

while those managing point-to-point integrations spend 3-6 months rebuilding

connections each time they expand.

Understanding Multi-Warehouse Models (And Their Trade-offs)

Different ownership models create different operational dynamics.

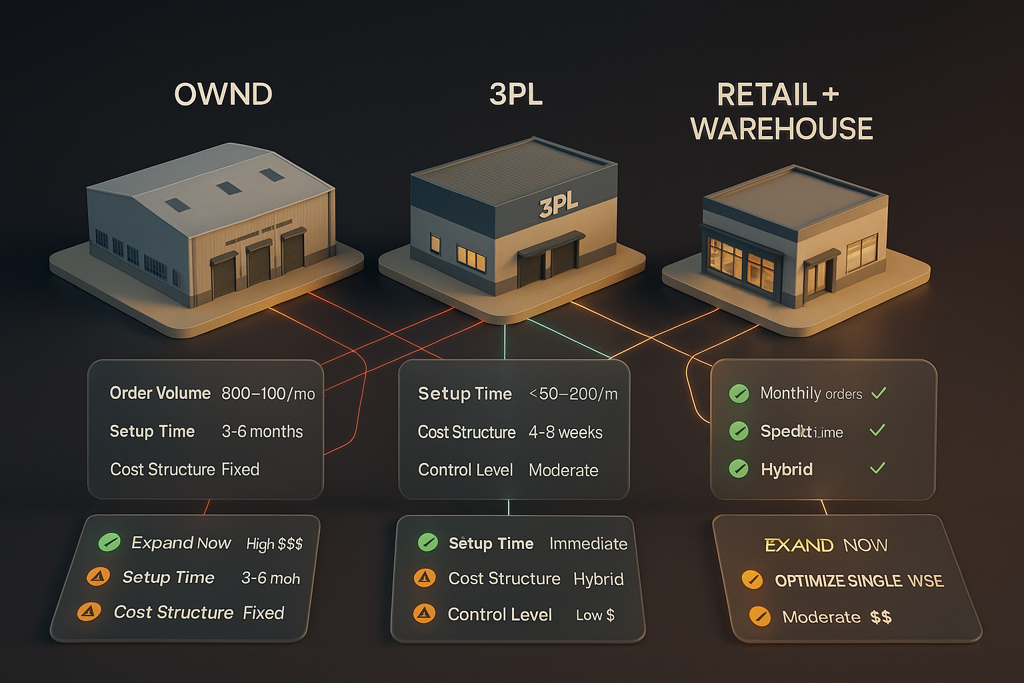

Owned Warehouses: Full Control, Higher Fixed Costs

You lease space, hire staff, own equipment, and control every process. Makes sense when order volume exceeds 800-1,000 monthly per location, product requires specialised handling, margin structure absorbs fixed costs, and long-term market commitment is certain.

Expect 3-6 months from lease signing to first shipment.

3PL Partnerships: Variable Costs, Faster Expansion

You send inventory to their facility. They receive, store, pick, pack, and ship. You pay per-transaction fees plus storage.

Best for testing regional demand, seasonal volume spikes, processing under 500-800 orders monthly per location, or when capital preservation matters. 3PLs need real-time order data and must push tracking back to your systems. API quality varies dramatically. Better 3PLs onboard in 4-8 weeks.

Retail Locations + Warehouse: Unified Inventory View

Physical stores hold inventory for both in-store sales and online fulfilment. Customers can BOPIS, ship-from-store, or browse inventory across all locations.

The challenge: retail POS systems weren't designed for warehouse fulfilment. Every in-store sale must immediately reduce online ATP. When store staff manually processes a walk-in sale but forgets to update the system, you've just oversold online.

Platforms like Exsited unify retail and warehouse inventory in real-time, preventing the overselling that happens when POS and online systems operate independently.

The Multi-Warehouse Inventory Problems You'll Actually Face

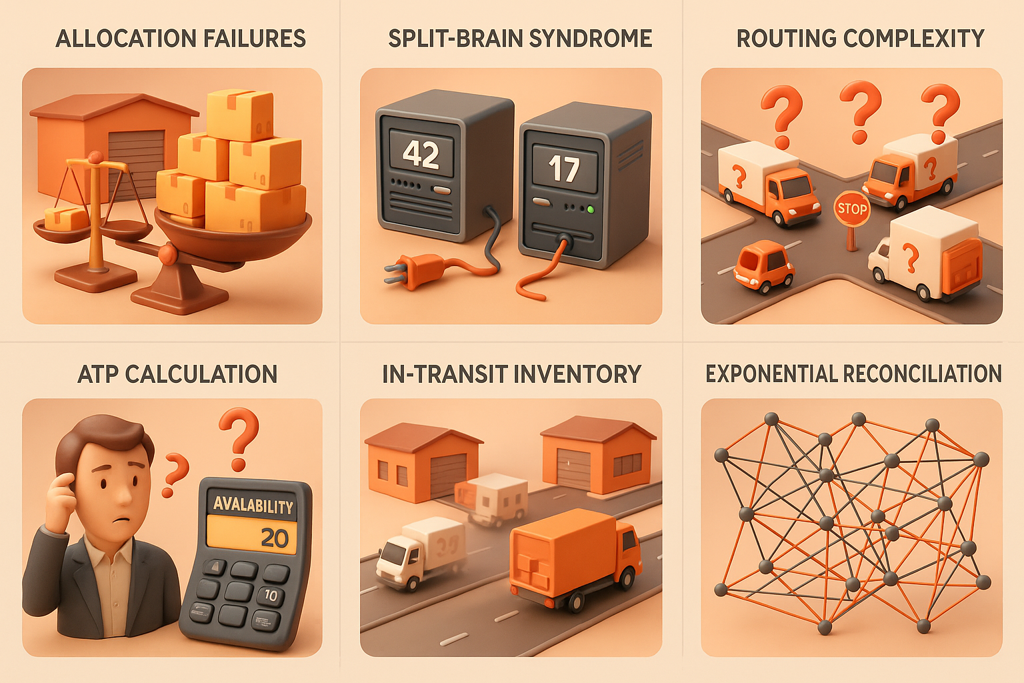

Allocation Failures (Stock in the Wrong Place)

Your total inventory shows 500 units available. Sydney warehouse holds 450. Melbourne has 50. Melbourne receives 200 orders. Sydney sits mostly idle.

Without demand-driven allocation, you'll constantly transfer stock between locations or disappoint customers with longer shipping times.

Split-Brain Syndrome (Systems Disagree on Reality)

Your ERP shows 200 units at Brisbane. Your WMS shows 185. Shopify displays 210. Which is correct? When systems update on different schedules or through fragile integrations, they develop independent versions of reality.

Most multi-warehouse inventory problems trace back to split-brain syndrome. Orders route based on incorrect ATP. Transfers don't synchronise properly. Customers see phantom stock.

This is why real-time inventory sync isn't optional for multi-warehouse operations. See our multi-channel inventory troubleshooting guide for diagnostic steps.

Real-world example: A home goods retailer operating two warehouses

discovered their ERP showed 200 units at Brisbane, WMS showed 185, and

Shopify displayed 210. The discrepancy emerged because:

- ERP updated immediately on PO receipt

- WMS updated only after physical receiving (2-4 hour lag)

- Shopify pulled from a cached API endpoint refreshing every 15 minutes

- Manual adjustments for damaged goods happened in WMS only

During a flash sale, 35 orders were placed for phantom inventory that

didn't actually exist in any warehouse. Customer service spent 12 hours

managing cancellations and angry customers.

After implementing Exsited's real-time sync orchestration, all systems

update within 30 seconds of any inventory movement. Split-brain scenarios

dropped from 2-3 incidents weekly to near-zero.

Routing Logic Complexity (Sending Orders to the Right Warehouse)

Simple rules break quickly:

- Proximity-based: Order from Perth postcode 6000 goes to Perth warehouse. But Perth is out of stock. What now?

- Load balancing: Distribute orders evenly. But Melbourne processes twice as fast as Brisbane.

- Cost optimisation: Always ship from cheapest location. But customers expect two-day delivery, not five-day from across the country.

Real routing logic requires business rules that consider multiple factors simultaneously and adapt based on current conditions.

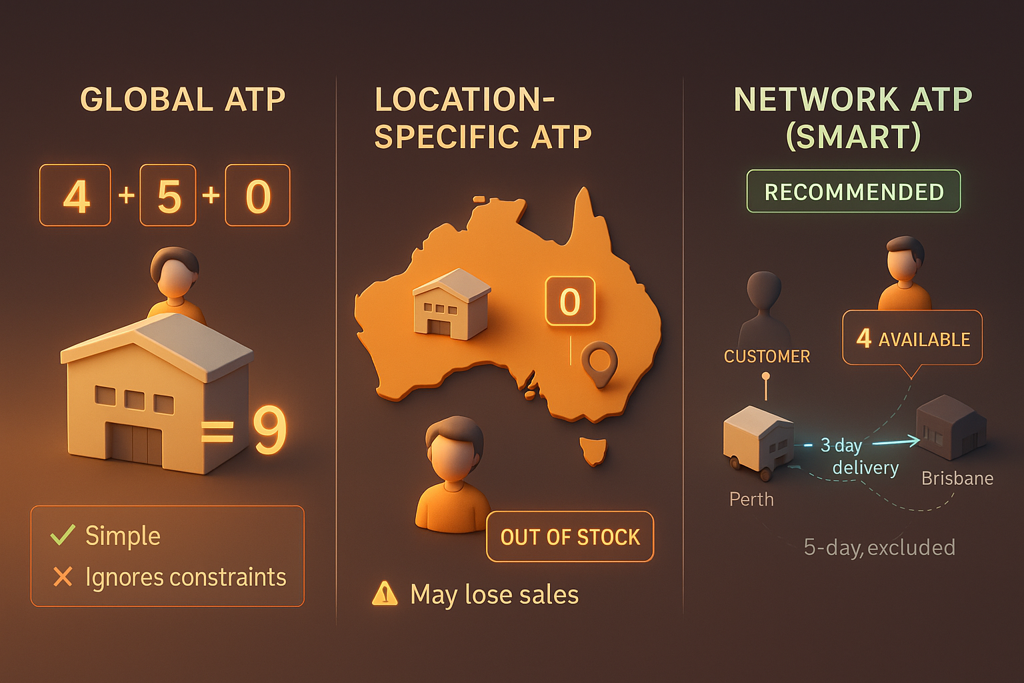

ATP (Available to Promise) Calculation Complexity

Single warehouse ATP is straightforward: On-hand minus Committed equals Available. Multi-warehouse ATP requires location awareness.

The challenge: Customer browses your Shopify store. Product page shows "15 available." Behind that number:

- Brisbane: 8 units (4 committed to pending orders)

- Melbourne: 7 units (2 committed)

- Perth: 0 units

What does "15 available" actually mean? If the customer is in Perth and you route by proximity, their "available" inventory is zero. If you calculate ATP globally but can't efficiently fulfil orders from distant warehouses, you're promising inventory you can't deliver economically.

Location-aware ATP strategies:

- Global ATP (Simplest): Sum ATP across all locations. Fast, but ignores routing constraints.

- Location-specific ATP: Show availability based on customer location. Accurate, but requires geolocation and may show "out of stock" when other warehouses have inventory.

- Network ATP (Most Accurate): Calculate based on routing rules and transfer capabilities. If Perth is out but Melbourne can ship with acceptable delivery time, include Melbourne's ATP. Complex but reflects operational reality.

Most businesses start with global ATP and evolve toward network ATP as they optimise operations. The key is that your platform must support the transition without rewriting integrations.

Technical Implementation Considerations

Single-warehouse ATP is a simple calculation: ATP = On-Hand - Committed - Safety Stock

Multi-warehouse ATP requires location-aware inventory states and business

rules:

Per-Location ATP = On-Hand (Location)

- Committed (Location)

- Safety Stock (Location)

- In-Transit (Outbound from Location)

- In-Transit (Inbound to Location, within transfer window)

The Transfer Window Problem

When Brisbane transfers 100 units to Melbourne, timing matters. Most retailers use a moderate approach: include in-transit inventory in routing decisions only within the expected transit window, but don't display in ATP until confirmed receipt. This balances availability accuracy with overselling risk.

Network ATP Calculation Example

Customer in Perth views product with 15 total units across network:

- Brisbane: 8 units, 4 committed = 4 ATP

- Melbourne: 7 units, 2 committed = 5 ATP

- Perth: 0 units

Simple Global ATP: Show "9 available" (sum of all ATP)

Location-Aware ATP: Show "Out of stock" (Perth has zero)

Network ATP (Smart): Show "4 available" (Brisbane can ship to Perth with

acceptable 3-day delivery, Melbourne 5-day delivery exceeds threshold)

Race Condition Prevention

Multi-warehouse environments increase race condition risk. If Brisbane and

Melbourne both have 1 unit ATP and two customers in different locations

place orders simultaneously, you can oversell.

Platform-based orchestration handles this through:

- Atomic ATP decrements (reservation confirmed before order accepted)

- Location-based inventory locks during checkout (30-second hold)

- Conflict resolution rules (which warehouse "wins" if simultaneous orders)

Point-to-point integrations struggle with race conditions because each

system maintains independent ATP calculations with sync delays.

Inter-Warehouse Transfers (Inventory in Transit)

When transferring stock between warehouses, inventory enters an in-transit state. Platforms like Exsited track this separately, automatically adjusting ATP at both source and destination, ensuring all sales channels see correct availability throughout the transfer process.

Reconciliation at Scale (Exponential Complexity)

Two locations mean reconciling ERP ↔ WMS at both warehouses + verifying each sales channel sees correct totals at each location. Five sales channels × two warehouses = ten inventory sync paths to maintain.

Add a third warehouse and you've got 15 sync paths. Fourth warehouse: 20 paths. The complexity grows exponentially while your ability to manually track it doesn't.

Fulfilment Routing Strategies: Where the Money Lives

Routing logic determines which warehouse fulfils which order. This decision drives customer experience, shipping costs, and warehouse capacity utilisation. Get it right and operations hum. Get it wrong and you're paying premium freight while customers wait.

Distance-Based Routing: Speed Optimisation

Routes to nearest warehouse with inventory. Ideal for time-sensitive products or premium segments where delivery speed drives competitive advantage. Limitation: ignores shipping cost differences.

Cost-Based Routing: Margin Optimisation

Routes to warehouse offering lowest shipping cost. Ideal for low-margin products where freight materially impacts profitability or markets where delivery speed doesn't affect conversion. Limitation: sometimes saves $2 while adding three days delivery.

Capacity-Based Routing: Load Balancing

Routes orders based on real-time pick queue depth, staff availability, and throughput rates. Ideal for high-volume operations where capacity constrains throughput or seasonal businesses with dramatic fluctuations. Limitation: can route sub-optimally for cost or speed to balance workload.

Hybrid Smart Routing (Multi-Factor Decision)

Most successful implementations use weighted algorithms considering proximity, cost, capacity, and stock levels simultaneously.

Example logic:

- Exclude warehouses without stock

- If multiple locations have stock, calculate weighted score:

- If multiple locations have stock, calculate weighted score:

- 40% proximity (delivery time)

- 30% cost (shipping rate)

- 20% capacity (available processing slots)

- 10% stock level (prefer locations with deeper inventory)

- Route to highest-scoring warehouse

- If primary location reaches capacity, automatically route to next-best option

This requires a platform that can execute complex business rules in real-time. Building this in custom code or trying to replicate it across multiple point-to-point integrations creates the maintenance nightmare we see businesses trying to escape when they call us.

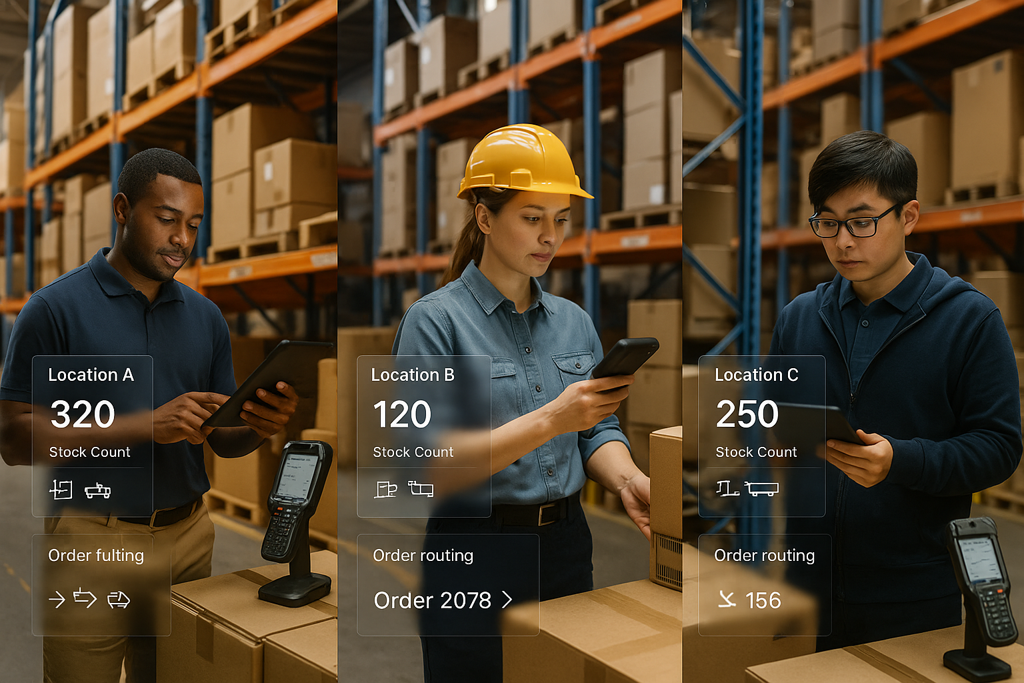

How Exsited Handles Multi-Warehouse Routing

The routing strategies above create real business value, but only if implementation doesn't consume months of development or require ongoing custom code maintenance.

Exsited treats routing logic as configurable workflow. Define your business rules through the platform:

- Distance-based priority with maximum threshold

- Cost thresholds for switching to cheaper warehouse

- Capacity monitoring with queue-based routing shifts

- Split shipment rules based on delay tolerance and cost impact

Real implementation example: An outdoor equipment retailer operates two owned warehouses (Melbourne and Brisbane) plus seasonal 3PL partnerships in Sydney and Perth. Their routing:

- VIC/SA/TAS orders → Melbourne (unless pick queue >4 hours, then Brisbane)

- QLD/NT orders → Brisbane preferred

- NSW orders → Sydney 3PL (Oct-Mar peak), Melbourne otherwise

- WA orders → Perth 3PL (peak season), Brisbane with express freight otherwise

- High-value orders (>$500) → Melbourne for QC regardless of location

During peak season, they enable Sydney and Perth 3PLs through configuration. After peak, they disable those routes. The warehouse strategy adapts while technical foundation remains stable.

When business priorities shift, adjust configuration rather than rewriting code. Platform-based routing keeps operations aligned with business priorities.

The alternative —routing logic buried in custom code —works beautifully until your lead developer leaves and takes all their tribal knowledge to their new job. Then you're left decoding cryptic IF statements at 2am, wondering why Perth orders keep routing to Melbourne during peak season.

Real Implementation: Fashion Retailer (Melbourne + Sydney)

A fashion accessories retailer operating Melbourne flagship warehouse and

Sydney 3PL was routing all NSW orders to Melbourne (overnight freight at

$15/parcel) because their routing logic lived in custom Shopify scripts that

couldn't check Sydney 3PL inventory in real-time.

During peak season, this cost them $23,000 in express freight overrides and

created 3-4 day delivery times for Sydney customers who could have received

next-day service from the local 3PL.

After migrating to Exsited's platform-based routing:

- NSW orders automatically route to Sydney 3PL when stock is available

- Melbourne handles VIC/SA/TAS orders

- Fallback routing activates when primary location hits capacity

- Average shipping cost dropped from $15 to $8 per NSW order

- Sydney delivery time reduced from 3-4 days to next-day

Peak season implementation: 6 weeks from kickoff to go-live. ROI achieved

in first peak season through freight savings alone.

Regional Inventory Strategy: Centralised vs Distributed

Centralised Stock: Deep inventory at one primary warehouse. Regional warehouses hold fast-moving SKUs only, with 2-3 day replenishment. Lower total investment and simplified forecasting, but requires frequent transfers.

Fully Distributed: Each warehouse maintains complete product range. Maximum flexibility and minimal transfers, but higher inventory investment and obsolescence risk.

Hybrid (Most Common): Fast movers at all locations. Medium velocity at 1-2 hubs. Slow movers centralised. Balances investment against flexibility.

Not all products justify distribution to all warehouses. Operations platforms like Exsited support location-specific catalogues, adapting to heterogeneous networks.

When Multi-Warehouse Expansion Doesn't Make Sense

Not every growth challenge requires geographic expansion. Multi-warehouse operations

introduce complexity that can harm rather than help in certain situations:

Under 500 Total Orders Monthly

Focus on optimising single-warehouse operations first. Route optimisation software

and better carrier negotiations typically deliver better ROI than adding locations

at this volume.

Highly Seasonal (80%+ Volume in 2 Months)

3PL partnerships often make more sense than owned warehouses. One outdoor retailer

we consulted with considered Brisbane + Sydney warehouses for their October-December

peak. Analysis showed that 3PLs in both locations during peak season, with all

fulfilment from Melbourne during off-peak, cost 35% less than year-round

multi-warehouse overhead.

Ultra-Fast Fashion (<6 Week Product Lifecycle)

Centralising inventory with premium express shipping often costs less than

distributed obsolescence risk. When products sell out or get marked down within

4-6 weeks, having the wrong stock in multiple locations amplifies markdown exposure.

Less Than $100k Annual Shipping Costs

ROI timeline extends beyond 3 years. Invest in inventory optimisation, demand

forecasting, and carrier negotiations instead.

Severe Cash Flow Constraints

Owned warehouses require significant upfront investment (3-6 months of lease,

equipment, and inventory positioning). 3PLs offer an alternative, but only if you

have systems ready to integrate. Attempting multi-warehouse expansion during cash

constraints often means cutting corners on integration infrastructure, which creates

the inventory problems this guide addresses.

When You Should Expand:

If annual shipping to one region exceeds $150,000 and you're experiencing delivery

time penalties that constrain growth, the expansion threshold has been crossed.

Every quarter you delay costs money and limits market penetration in high-opportunity

regions.

When Multi-Warehouse Meets Multi-Channel

For businesses operating multiple sales channels, multi-warehouse architecture becomes part of your broader multi-channel inventory management strategy. The orchestration layer that routes orders to warehouses is the same layer that synchronises inventory across Shopify, Amazon, POS, and B2B channels. For businesses using NetSuite specifically, our NetSuite Shopify connector guide shows how to sync inventory across all these channels while coordinating multi-warehouse fulfilment with your ERP as the single source of truth.

This is why Exsited exists. Multi-warehouse inventory management, multi-channel synchronisation, ERP integration, and workflow automation aren't separate problems requiring separate solutions. They're operational challenges requiring unified orchestration.

Businesses using Exsited for multi-warehouse operations typically also use it for real-time inventory sync across channels, custom approval workflows, role-based dashboards, and integration with ERPs and sales platforms. The platform grows with your business complexity while technical complexity stays manageable.

McKinsey's research on integrated technology operating models shows that companies unifying digital and IT operations into product-and-platform architectures are 60% more likely to turn technology investments into measurable business value compared to those managing siloed systems. The pattern holds in multi-warehouse operations: unified orchestration platforms outperform fragmented point-to-point integrations in scalability, adaptability, and time-to-value.

A pattern we've observed across 50+ implementations: Businesses using platform-based

orchestration add new warehouses in 2-4 weeks from decision to go-live. Those

managing point-to-point integrations spend 3-6 months rebuilding connections each

time they expand. One outdoor equipment retailer had delayed their Perth expansion

for 18 months specifically because "we'd have to rebuild all our Shopify and Amazon

integrations." After migrating to Exsited, they onboarded the Perth 3PL in 11 days.

The warehouse strategy became adaptable rather than locked into technical constraints.

Next Steps

Experiencing inventory sync issues right now? Our multi-channel inventory troubleshooting guide walks through diagnostic steps for overselling on multiple channels and inventory not syncing across channels, with platform-specific fixes you can implement today.

Building the business case internally? Our cost analysis guide helps you calculate what manually updating inventory actually costs your business, with frameworks by company size and ROI calculators for automation investment.

Need ERP-level integration? If multi-warehouse expansion connects to broader financial and operational systems, our guide to NetSuite Shopify integration covers the transition from inventory management to full ERP integration with multi-entity support.

Ready to model multi-warehouse economics for your specific business? Book a workflow review and we'll map your systems and requirements, model routing logic for your network, and provide implementation timeline and costs.

The right time to add your second warehouse is typically six months before you think you need it. The infrastructure you build determines whether expansion becomes your growth engine or your next operational bottleneck.

References

IHL Group. (2023). Retail inventory distortion: The good, the bad, and the ugly. Blue Yonder. https://blueyonder.com/resources/retail-inventory-distortion-report

Deloitte Digital (2023). B2B Commerce Trends: Unleashing New Channels for Revenue Growth. https://www.deloittedigital.com/content/dam/digital/global/legacy/documents/offerings/offering-20231108-b2b-commerce-trends.pdf

McKinsey & Company. (2021). Omnichannel: It’s time for the online tail to wag the retail dog. McKinsey & Company. https://www.mckinsey.com/industries/retail/our-insights/omnichannel-its-time-for-the-online-tail-to-wag-the-retail-dog

Gessa, A., Jiménez, A., & Sancha, P. (2023). Exploring ERP systems adoption in challenging times: Insights of SMEs stories. Technological Forecasting and Social Change, 195, 122795.

https://www.sciencedirect.com/science/article/pii/S0040162523004808